At Ficzner Group, we want to be prepared to ensure that you are given the best buying experience with knowledge and expertise to guide you along the way. We are here to guide you on purchasing a brand new home in Ohio.

Today I would like to talk to you about What Lower Mortgage Rates Mean for Your Purchasing Power

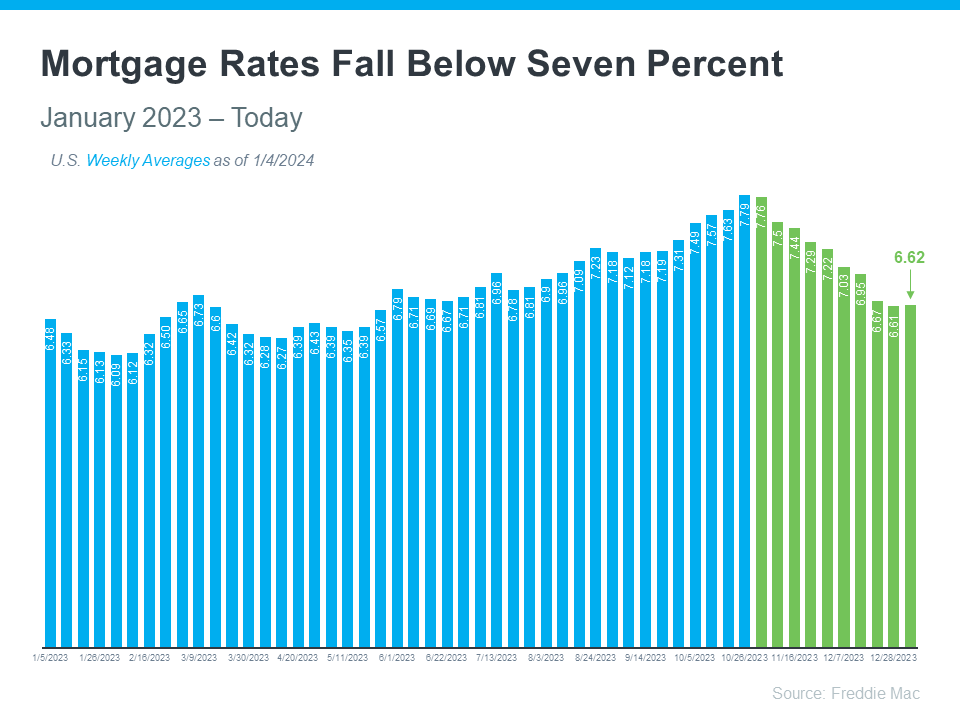

If you want to buy a home, it’s important to know how mortgage rates impact what you can afford and how much you’ll pay each month. Fortunately, rates for 30-year fixed mortgages have come down significantly since the end of October and are currently under 7%, according to Freddie Mac (see graph below):

This recent trend is great news for buyers. As a recent article from Bankrate says:

“The rate cool-off somewhat eases the housing affordability squeeze.”

And according to Edward Seiler, AVP of Housing Economics and Executive Director of the Research Institute for Housing America at the Mortgage Bankers Association (MBA):

“MBA expects that affordability conditions will continue to improve as mortgage rates decline . . .”

Here’s a bit more context on how this could help with your plans to buy a home.

How Mortgage Rates Affect Your Search for a Home

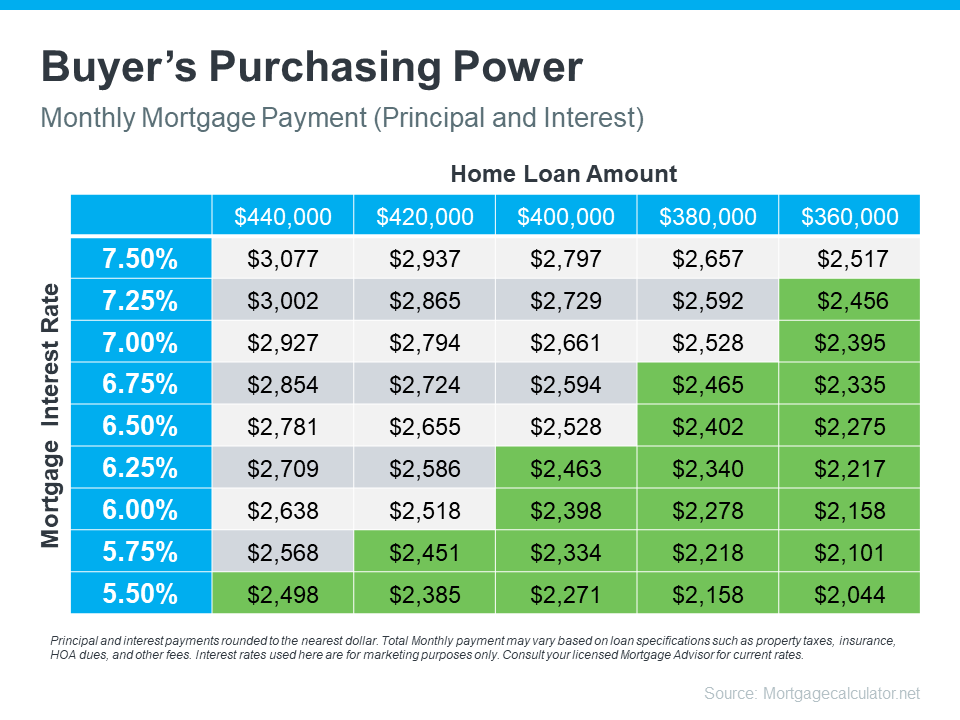

Understanding the connection between mortgage rates and your monthly home payment is crucial for your plans to become a homeowner. The chart below illustrates how your ability to afford a home changes when mortgage rates shift. Imagine your budget allows for a monthly payment between $2,400 and $2,500. The green part in the chart shows payments in that range or lower (see chart below):

As you can see, even small changes in rates can affect your budget and the loan amount you can afford.

Get Help from Reliable Experts To Understand Your Budget and Plan Ahead

When you’re looking to buy a home, it’s important to get guidance from a local real estate agent and a trusted lender. They can help you explore different mortgage options, understand what makes mortgage rates go up or down, and how those changes impact you.

By looking at the numbers and the latest data together, then adjusting your strategy based on today’s rates, you’ll be better prepared and ready to buy a home.

Bottom Line

If you’re looking to buy a home, you should know the recent downward trend in mortgage rates is good news for your move. Let’s connect and plan your next steps.

Source.. KCM Mike Ficzner Blog

The Ficzner Group is a technology-driven local real estate company that serves the Lake, Geauga & Cuyahoga County areas. Our sales team of Zillow Premier Agents use advanced search technologies that make searching the web seamless and marketing your home instant within the Zillow & Trulia Marketplace.

To connect with us directly,

Please call Mike at 440-305-6349

Or via email: REALESTATE@FICZNER.COM

Visit us at www.ficzner.com- Call or text 440-305-6349 for more information