At Ficzner Group, we want to be prepared to ensure that you are given the best buying experience with knowledge and expertise to guide you along the way. We are here to guide you on purchasing a brand new home in Ohio.

Today I would like to talk to you about Is Affordability Starting To Improve?

Over the past couple of years, a lot of people have had a hard time buying a home. And while affordability is still tight, there are signs it’s getting a little better and might keep improving throughout the rest of the year. Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), says:

“Housing affordability is improving ever so modestly, but it is moving in the right direction.”

Here’s a look at the latest data on the three biggest factors affecting home affordability: mortgage rates, home prices, and wages.

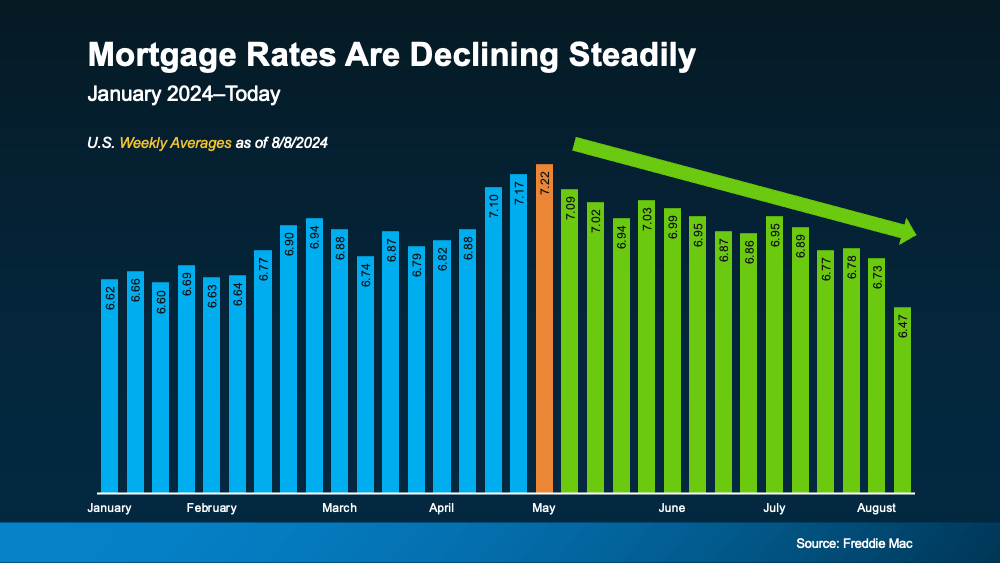

1. Mortgage Rates

Mortgage rates have been volatile this year, bouncing around from the mid-6% to low 7% range. But there’s some good news. Data from Freddie Mac shows rates have been trending down overall since May (see graph below):

Mortgage rates have improved lately in part because of recent economic, employment, and inflation data. Moving forward, some rate volatility is to be expected. But if future economic data continues to show signs of cooling, experts say mortgage rates could keep going down.

Mortgage rates have improved lately in part because of recent economic, employment, and inflation data. Moving forward, some rate volatility is to be expected. But if future economic data continues to show signs of cooling, experts say mortgage rates could keep going down.

Even a small drop can help you out. When rates decline, it’s easier to afford the home you want because your monthly payment will be lower. Just don’t expect them to go back down to 3%.

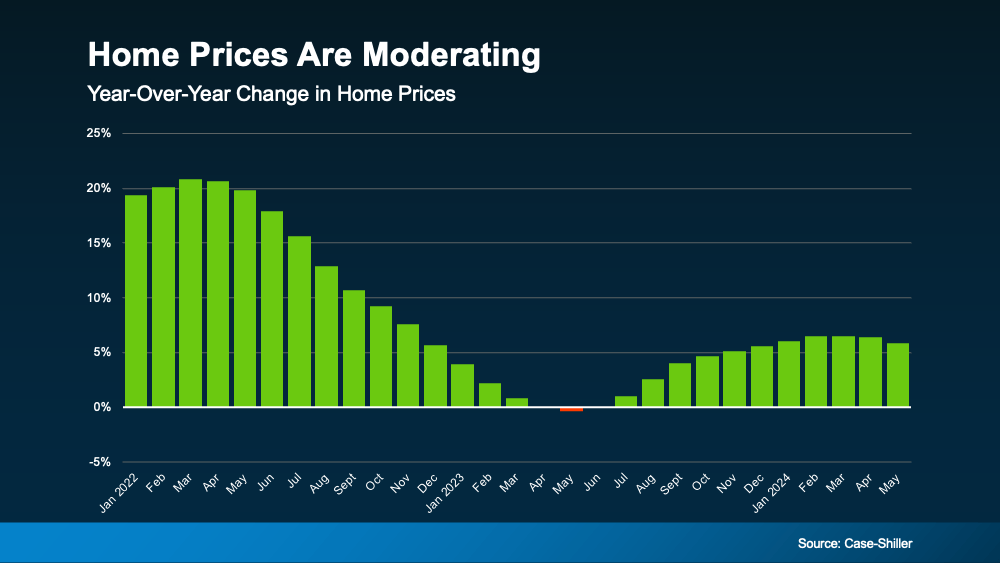

2. Home Prices

The second big thing to think about is home prices. Nationally, they’re still going up this year, but not as fast as they did a couple of years ago. The graph below uses home price data from Case-Shiller to illustrate that point:

If you’re thinking about buying a home, slower price growth is good news. Home prices went up a lot during the pandemic, making it hard for many people to buy. Now, with prices rising more slowly, buying a home may feel less out of reach. As Odeta Kushi, Deputy Chief Economist at First American, says:

If you’re thinking about buying a home, slower price growth is good news. Home prices went up a lot during the pandemic, making it hard for many people to buy. Now, with prices rising more slowly, buying a home may feel less out of reach. As Odeta Kushi, Deputy Chief Economist at First American, says:

“While housing affordability is low for potential first-time home buyers, slowing price appreciation and lower mortgage rates could help – so the dream of homeownership isn’t boarded up just yet.”

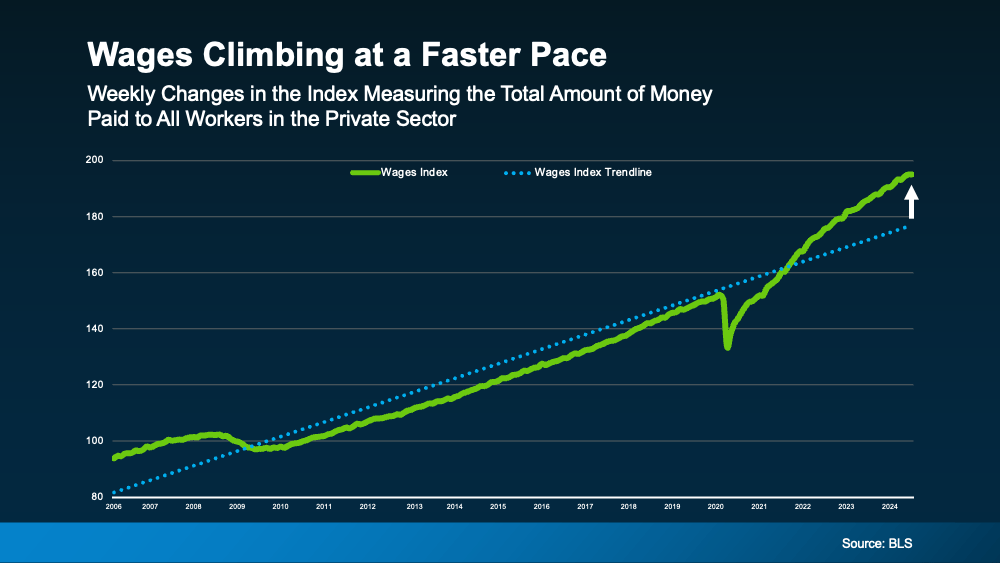

3. Wages

Another factor helping with affordability is rising wages. The graph below uses data from the Bureau of Labor Statistics (BLS) to show how wages have increased over time:

Look at the blue dotted line. It shows how wages usually go up in a typical year. On the right side of the graph, you’ll see wages are rising even faster than normal right now – that’s the green line.

Look at the blue dotted line. It shows how wages usually go up in a typical year. On the right side of the graph, you’ll see wages are rising even faster than normal right now – that’s the green line.

This helps you because if your income increases, it’s easier to afford a home. That’s because you won’t have to spend as much of your paycheck on your monthly mortgage payment.

Bottom Line

When you put all these factors together, you see mortgage rates are trending down, home prices are rising more slowly, and wages are going up faster than usual. Though affordability is still a challenge, these trends are early signs things might be starting to improve.

Source.. KCM Mike Ficzner Blog

The Ficzner Group is a technology-driven local real estate company that serves the Lake, Geauga & Cuyahoga County areas. Our sales team of Zillow Premier Agents use advanced search technologies that make searching the web seamless and marketing your home instant within the Zillow & Trulia Marketplace.

To connect with us directly,

Please call Mike at 440-305-6349

Or via email: REALESTATE@FICZNER.COM

Visit us at www.ficzner.com- Call or text 440-305-6349 for more information